Over the past 12 months, many new employment laws and regulations have been adopted, affecting the way employers hire, pay, treat and provide benefits to their employees. Here's a look at three trends that are likely to continue in 2023.

#1: New leave requirements

Leave of absence requirements continue to expand dramatically. Here are some examples.

Paid family leave:

A growing number of jurisdictions provide partial wage replacement when employees take leave for certain family or medical reasons. These paid family leave (PFL) programs are typically funded through payroll deductions. Many of the laws establishing such programs also provide job protection for employees and impose other requirements on employers.

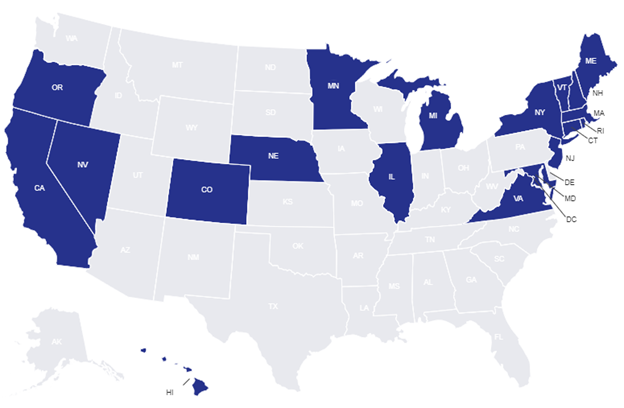

Currently, there are 13 states and one local jurisdiction with a paid family leave program. Click on the locations below to see the details.

States with a paid family leave program |

|

|

|

Other states and local jurisdictions are likely to consider such programs this year.

Bereavement leave:

Some states are enacting or expanding requirements for employers to provide bereavement leave to employees. For example, effective January 1, 2023:

- California requires employers with five or more employees to offer up to five days of bereavement leave. Unless the employer has an existing paid bereavement leave policy, the leave provided under the law may be unpaid, but employees are entitled to use accrued sick leave or other paid time off for this purpose.

- Illinois expanded its existing bereavement leave requirement to cover more family members and more situations. The state’s bereavement leave requirement applies to employers with 50 or more employees. Eligible employees may take up to two weeks of unpaid bereavement.

Over the next year, other state and local jurisdictions could consider similar changes.

#2 Increased pay requirements

Minimum wage:

On January 1, 2023, more than 20 states and 40 local jurisdictions increased their minimum wages. And, some states and local jurisdictions scheduled their changes for another point during the year. Here are some examples:

Date |

State and local jurisdictions |

|

March 1 |

In New Mexico: Santa Fe |

|

June 1 |

Connecticut |

|

July 1 |

District of Columbia |

|

Sept. 30 |

Florida |

Note: The Michigan Court of Claims has ruled that the legislature violated the state’s Constitution when it adopted and then amended ballot initiatives to increase the minimum wage. If left standing, the ruling means the original versions of those laws would apply and the minimum wage could increase again to $13.03 per hour as early as February 19, 2023. Michigan employers should watch closely for developments.

Overtime exemption:

State:

Many states have their own salary and duties tests for determining whether an employee is exempt from overtime under state rules. In some cases, the state’s minimum salary requirement for overtime exemption is tied to the minimum wage. Therefore, when the minimum wage increases, the minimum salary requirement for overtime exemption increases. This impacted employers in six states on January 1, 2023 (or December 31, 2022):

State |

Minimum salary requirement for overtime exemption in 2023 |

|

Alaska |

$868 per week |

|

California |

$1,240 per week |

|

Colorado |

$961.54 per week |

|

Maine |

$796.17 per week |

|

New York (in areas other than New York City, Nassau, Suffolk and Westchester Counties) |

$1,065 per week (December 31, 2022) |

|

Washington |

$1,101.80 per week (50 or fewer employees) |

Note: The above salary thresholds apply to only certain exemptions, and the state’s duties tests must also be satisfied to be classified as exempt from overtime. See your state rules for details. In Colorado and certain other states, an exempt employee’s salary generally must also be sufficient to satisfy the minimum wage for all hours worked in a workweek. Employers may want to consult legal counsel about how this rule may impact them.

Federal:

The U.S. Department of Labor (DOL) is expected to propose a rule in 2023 that would increase the minimum salary required to be exempt from overtime under federal law. Currently, the minimum salary requirement for the administrative, professional (including the salaried computer professional) and executive exemptions from overtime is $684 per week. ADP is monitoring the situation closely and will provide information and resources should the DOL publish a proposed rule.

If a proposed rule is published, the public would be given a certain amount of time to comment on it. At the end of the public comment period, the DOL would review the comments and consider them as the agency contemplates a final rule. If the DOL decides to publish a final rule, employers would be given a certain amount of time to comply. The entire regulatory process typically takes several months.

#3: More pay transparency rules

Currently, twenty states and the District of Columbia have enacted laws that expressly prohibit employers from banning employees from discussing their wages, several joining the list in the last year. The states with these laws include:

Some local jurisdictions have also enacted similar laws. Check your state and local laws for details.

In addition, several states and local jurisdictions now require private sector employers to disclose the pay range for a position to an applicant or employee. Here are some examples of laws that require such disclosures:

State or local jurisdiction |

Covered employers |

Pay disclosure requirements |

|

California |

All |

|

|

Colorado |

All |

In each posting for each job opening, an employer must disclose:

|

|

Connecticut |

All |

Employers must:

|

|

Maryland |

All |

Upon request, an employer must provide an applicant with the wage range for the job for which the applicant applied. |

|

Nevada |

All |

Employers must:

|

|

Jersey City, New Jersey |

Employers with five or more employees |

Employers that use any print or digital media circulating within the city to provide notice of employment opportunities must disclose a minimum and maximum salary and/or hourly wage, including benefits, in the posting or advertisement. |

|

New York (effective 9.17.2023) |

Employers with four or more employees |

When advertising a job, promotion, or transfer opportunity, employers must state the minimum and maximum annual salary or hourly wage for the position. |

|

New York City, New York |

||

|

Ithaca, New York |

||

|

Westchester County, New York |

||

|

Cincinnati, Ohio |

Employers with 15 or more employees |

Upon request, employers must provide the pay scale for a position to an applicant who has received a conditional offer of employment. |

|

Toledo, Ohio |

||

|

Rhode Island |

All |

Employers must:

|

|

Washington |

Employers with 15 or more employees |

In each posting for each job opening, employers must disclose the wage scale or salary range and a general description of all benefits and other compensation. |

Expect to see more states and local jurisdictions consider joining the trend in the coming months.

Conclusion:

Watch for developments closely and review your workplace forms, policies, practices and training to help ensure compliance when changes occur.